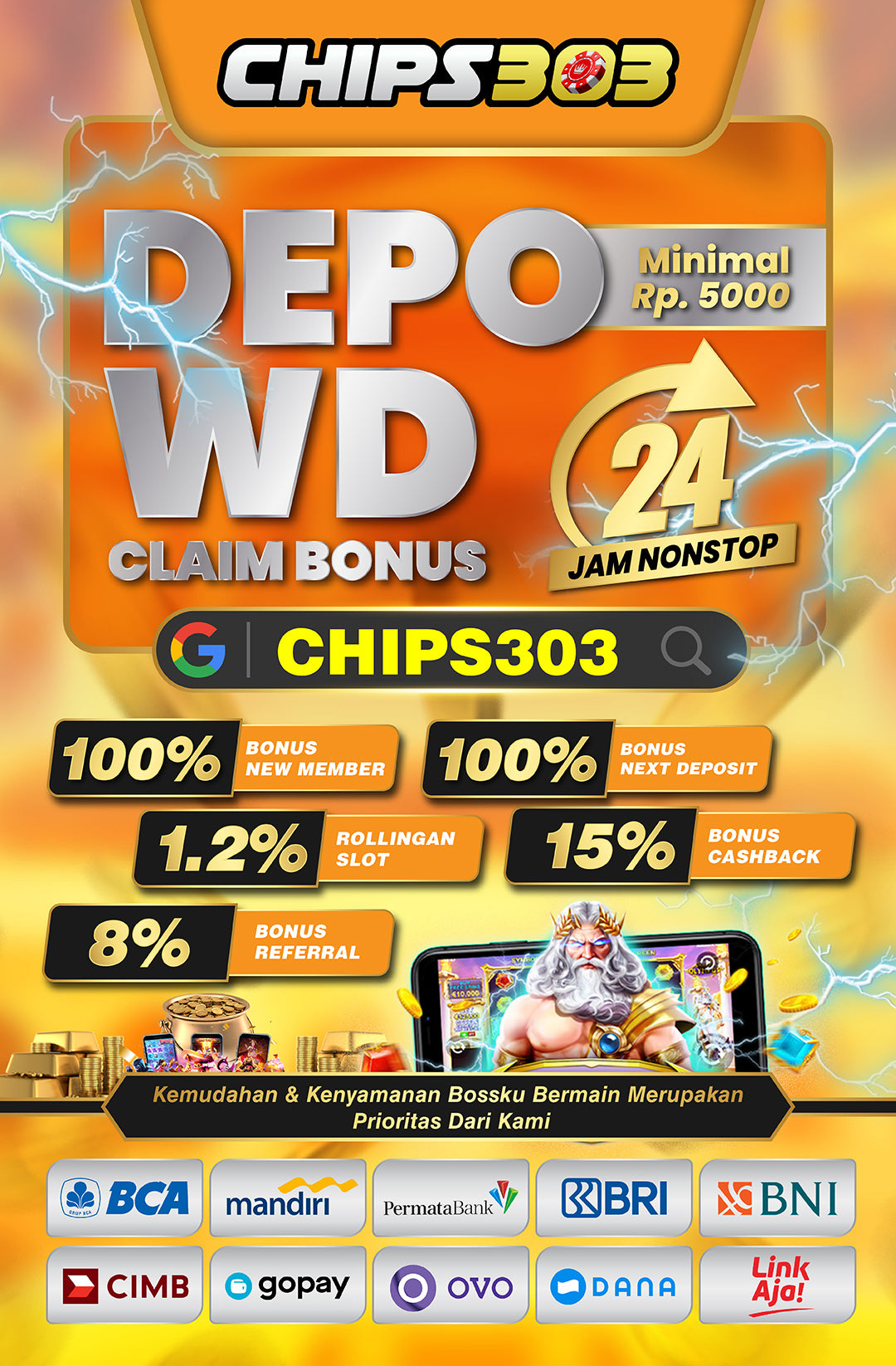

CHIPS303

Chips303Login Zoom Engine Slot

CHIPS303 Login Link Alternatif Terbaru dan Resmi . Jika beberapa anggota setia CHIPS303 mengalami kesulitan untuk terhubung ke situs web, Anda dapat langsung mengklik Segi Login atau Daftar di atas. Ini aman untuk diakses meskipun situs web diblokir oleh firewall Internet.

Situs Slot Zoom Engine Terbaru 2022 CHIPS303 Menawarkan Jackpot Terbesar yang Mudah Menang Dengan Bet Murah dengan Deposit Ovo, Dana, Gopay, dan Linkaja. Kami adalah situs judi Zoom Engine Slot terbaik di Indonesia dan kami menyediakan berbagai permainan bola, kasino, dan slot online dari berbagai penyedia judi terkemuka internasional seperti SBOBET, CQ9, Habanero, dan banyak lagi.

Zoom Engine Slot Login Terbaru Di Chips303

Link Login CHIPS303 dirancang untuk memastikan bahwa Anda selalu terhubung ke link login alternatif dari situs CHIPS303, yang disebutkan sebelumnya sebagai link alternatif resmi dan aman dari agen CHIPS303. Jika Anda mengalami masalah dengan proses login dan daftar di slot Zoom Engine Terbaru, Anda dapat langsung terhubung ke bagian LOGIN atau DAFTAR. Customer Service CHIPS303 akan membantu Anda dalam proses ini selama 24 jam.

View full details